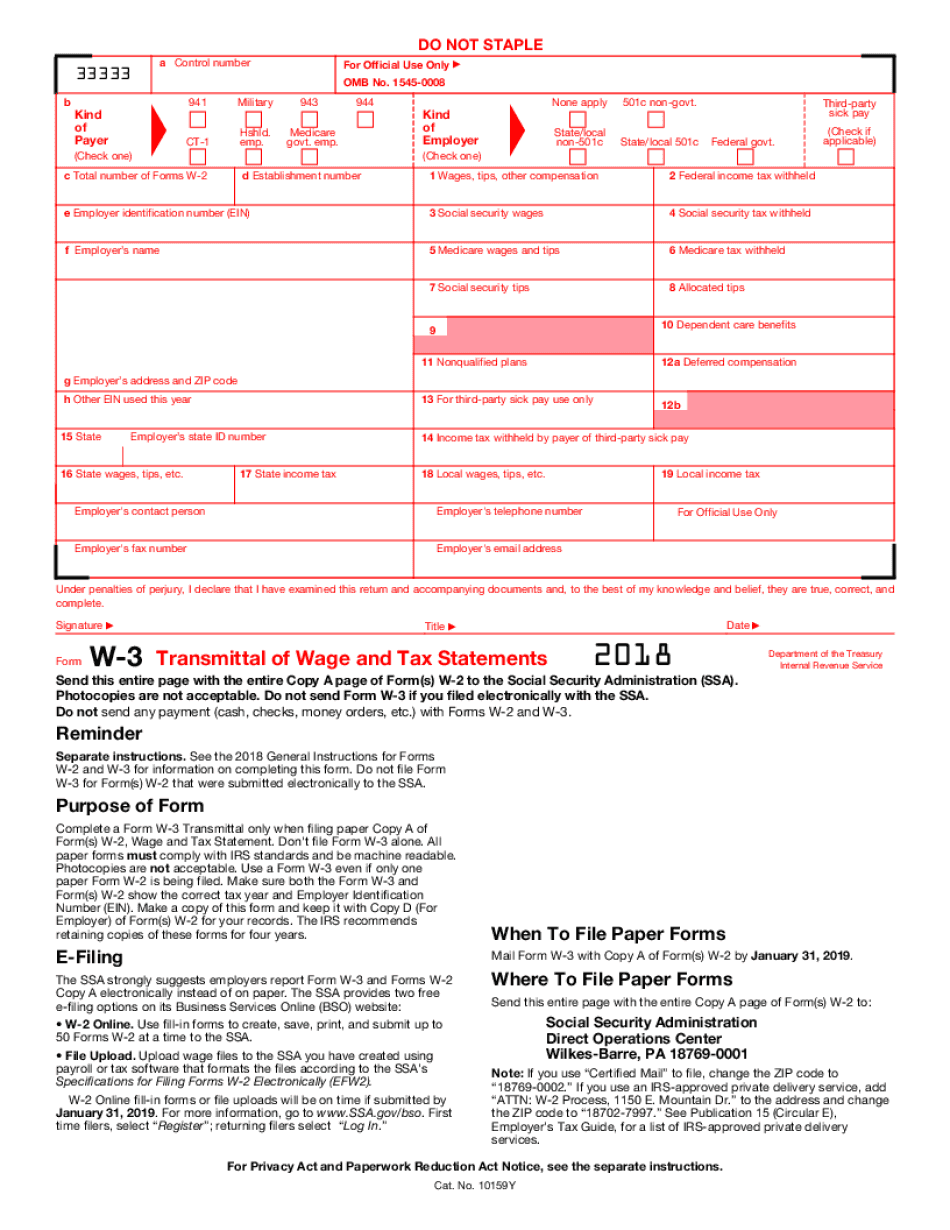

Filling out IRS W-3 2018 Form online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to IRS W-3 2024 Form

Every person must report on their finances on time during tax season, providing information the Internal Revenue Service requires as precisely as possible. If you need to IRS W-3 2024 Form, our trustworthy and user-friendly service is here to help.

Follow the steps below to IRS W-3 2024 Form quickly and precisely:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official guidelines (if available) for your form fill-out and accurately provide all information required in their appropriate fields.

- 03Fill out your document using the Text option and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the toolbar above.

- 05Make use of the Highlight option to accentuate specific details and Erase if something is not applicable any longer.

- 06Click the page arrangements key on the left to rotate or delete unwanted file sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to make sure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal report delivery.

Select the best way to IRS W-3 2024 Form and declare your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

Watch our video guide to learn how to prepare IRS W-3 2018 Form

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of IRS W-3 2018 Form?

The purpose of IRS W-3A W-3B W-4A W-5A W-6A W-7A W-8A W-9A W-14A W-2A W-12A W-13A W-14A W-1A W-13A W-3A W-17C W-19C W-2C W-10B

IRS W-3P

The IRS W-3P describes tax-exempt groups. The form must be completed for all tax-exempt organization or for tax-exempt organization of any type.

Form W-3P is a W-1 form that will be completed by all organizations that require a W-3 from the IRS. It needs to be completed before you file your W-3, and is due within 10 days after your taxes were reported. If you do not complete it then you will need the last 8 pages and the 2-column page to complete your W-3P Form.

The Form must state the name of the organization, the address and phone number of the person in charge to issue it, the name of the organization, the number of persons who may represent the organization, and their addresses and telephone numbers. You will also need the name of any officer or governing person required to send out copies of the W-3, and the group's name.

W-4A

The W-4A is completed by individuals who are required to file Form W-2. The Form is due 14 days after the end of the calendar year or within 14 days of the end of the month.

W-5A

As a tax-exempt organization, the IRS will require IRS W-5A to be completed by individuals who are required to file Form W-7. It needs to be completed within 10 days of the end of the calendar year or within 10 days of the end of the month.

The Form W-5A is due within 14 days or 30 days of the end of the calendar year or by the 30th day of the month following the month of the tax return filing, whichever occurs first.

The W-5A must indicate the tax due for the previous year, which is due to the tax return filing date. It can be in the form of a 100 check or a wire transfer.

Who should complete IRS W-3 2018 Form?

This form is for you if you:

Have a business

Wrote a W-3 with your name on it

Used Form 1099-MISC instead of Form W-2 for a sole proprietorship

What to include in the “W-3”

For most types of businesses, you need to complete Schedule A and include the following information on your W-3:

Your name, address, and date of birth

Date of incorporation; and Tax ID number (if applicable)

Number of shareownerships

Amount that you are entitled to receive in the form of cash

Your net income or profit

Your net income or profit divided into the following parts, where each part equals 100 or less:

Rent

Fees and other expenses not allocated from profits

Capital investments

Capital lease payments

Other net income or profit

What you can't include on your W-3

You may be able to exclude certain types of income and expenses on your W-3.

You cannot include:

Noncash items to the value of 600 or more, unless you report them as an item in box 1 of your tax return.

Dividend payments, as long as the actual payment was 1 or more per share or 30 or less in excess of your required minimum distribution of 3,000. These payments don't count as taxable income if you paid them to another individual as gifts, bequests, or inheritances, as long as you reported them in box 2 of your tax return or if you reported them as non-cash items in box 13 of Form 1099-MISC

Dividend distributions or distributions of excess cash, or of nonqualified pension or annuity income, unless the distribution is reported in box 2 or 13 of your tax return

Rental income. (Eligible income includes rental income from a residential property that you own and can show is subject to tax.) You cannot report rental income from an ownership interest in a single-family property or condominium that you rent out to tenants. You can report rental income from property that is owned as the tenant's only or principal residence if you meet both of the following requirements. If the property is used or used as a residence; and The rental income is not more than a prescribed percentage of the owner's adjusted gross income.

When do I need to complete IRS W-3 2018 Form?

You have until March 15 to report your W-3 and the date you paid income, social security and Medicare taxes, if you are required to do so. Then it's April 15 for 2018 Form W-9.

How much do I have to pay?

Under section 6721(c) of the 1986 Code, each calendar year you need to include in your gross income the amount of all payments you are required to make, without regard to when they were made, to the United States Government and any agency thereof or to an office or agency thereof.

For 2018, you have to pay 31,000, plus 14,000 for each filing period in 2018 through the end of the calendar year ending in March 2019.

The last day you have to file if you fall within one of these categories is April 15 for 2018 Form W-3.

If you do not meet the requirements due to other deductions you may find yourself owing a tax to your federal taxes instead. In some states, if you are an American citizen or resident, and you pay state income taxes of over 1,100 due or over 5,000 a year, the state can assess a state income tax for the amount of your state income taxes. Check with the state government to make sure you are not already liable for that tax.

When do I have to turn in my 2017 W-2 Form?

You have until March 1 for your first filing of 2017 Form W-2. You will not have a failure to file penalty if you do not do the paperwork until the March 15 federal deadline for filing 2017 taxes. For your filing status change, the deadline to convert your income to a new tax form is 6 months later. Otherwise, you will owe penalties until your penalty begins being due.

If the period is not six months but more than 180 days before the April 15 deadline, it must be extended if it was not properly started within the earlier time frame.

When can I adjust my withholding to be up to date and correct for my 2017 earnings?

Under section 6402(b)(2)(E)(ii) of the 1986 Code, you can have your withholding adjusted to the amount of the additional tax. If you did not realize an extra tax in 2017, you cannot adjust your withholding until January 15.

You must do this whether you have a failure to file penalty.

Can I create my own IRS W-3 2018 Form?

We do not recommend using an IRS Form W-3 form to calculate your tax liability.

Your individual tax liability has already been determined by use of the Form 1040 and the corresponding Tax tables in chapter 3 at.

What should I do with IRS W-3 2018 Form when it’s complete?

The form should be sent to the person you designated in your filing status (not to anyone else). You will get a Form W-3, Employee's Withholding Allowance Certificate, indicating the amount of withholding you claimed on the Form W-3.

If you have more than one payer, your Form W-3 will show the names of the payers. If you do not have multiple payers, your Forms W-3 will show the names and Social Security number(s) of the payers.

When should I ask for a tax refund?

You should ask for a refund within 3 months of the last return you filed.

What if I did not claim withholding?

If you did not claim withholding, you can still ask for a tax refund using your original Form W-3, with adjustments that you made to reduce your withholding. You have three options for making these adjustments:

You can request a review using Form 4852, W-3 Adjustment Request. This form includes an explanation of the withholding error.

You can file and ask for an IRS Taxpayer Assistance Program (TAP) payment. The federal tax code requires TAP payments if you have a filing status other than “non-resident alien.”

You can file and ask for a refund using a paper request form. (To print a TAP check, go to IRS.gov and search for “Tax Payment Instructions.” The IRS will send you a check. Note that your request form must be completed the same day it is received.)

Do I still have to file my state tax return?

Even with all the instructions in the Form 4852, you still have to file your state taxes.

If you have any state tax questions, contact the Missouri Tax Commission. The Missouri Tax Commission is located at:.

What is an “overpayment”?

An overpayment is a return that is less than the amount of tax that the IRS had initially withheld. In other words, the return was not reported according to instructions. An overpayment also can occur if you overpay an income tax withholding on an income tax return. You must include in your tax return any overpayment. The IRS can request that you pay that overpayment.

How do I get my IRS W-3 2018 Form?

You can order a W-3 2018 by calling 2-1-1 or visit us at IRS.gov/OACT.

For more information about the 2018 Form W-3 filing requirements call the Taxpayer Assistance Center at or visit IRS.gov/TAC.

Filing Instructions and Additional Information

Related Questions

Where can I obtain copies of your Form W-3?

IRS.gov/FormW3.

Where should I send my Form W-3 (W-3)?

You must send your Form W-3 to the address listed on the Form W-3. Do not mail your Form W-3 to any IRS facility.

Do I have to return copies of Form W-3 to the address listed on the form?

No, you do not need to return copies of Form W-3 to the address listed on the form. However, if you have questions or a complaint regarding your Form W-3, you should report them to the IRS at (TTY: 1-800-TAX-1040). You can also use Form 4506-T (PDF).

What if I have not filled the necessary boxes on my Form W-3?

There are certain situations where you may need additional information during the W-3 Filing Processing, but do not fill out the required boxes. To help you fill out a Form W-3 properly, you may want to review the following questions and answers:

What are the tax filing deadlines?

For Forms W-2, W-3, 1099/S, 1098-EZ, GST/HST, and most other forms (like Form 709 and Form 8821), the tax deadline is 12 months after the end of the taxable year for which the return or statement was filed. For some forms, like Forms 8903 and 9412, the tax deadlines are 12 months after the date the return or statement is filed (the date your return or statement is available).

For certain tax forms, e-file, the tax deadlines are 30 days after the due date of the return or statement.

For Forms 810 and 842, the tax deadlines are 10 months after the due date of the return or statement.

What documents do I need to attach to my IRS W-3 2018 Form?

In addition to the W-3, you may need several other documents. These documents may include: A copy of the new IRS form with your W-3 on it. Any tax due on the old form will need to be withheld. If you are a sole proprietor or a partner with a partner company, see the “Form 1040A” for instructions regarding withholding.

Any tax shown in box 1a of box 18 of the old W-3.

You will file a separate W-9 form with your income tax return.

A copy of the new W-3 and Form 1065.

Any financial documents such as bank statements.

If you are a partner with a partner company, see the “Form 1040A” for instructions regarding withholding. This document should not be mailed out to your tax preparer.

If you already received W-2 slips, you must submit Form W-2G and follow the instructions on that form. Please note: Form W-2 is a paper form that cannot be scanned or e-filed.

How do I update the information on my W-2 form? It is recommended that you update all the information on your W-2 forms with your new information. For example, if your W-2 shows the address of your business in Massachusetts, update your address with that of your business in Delaware.

What if you have not received Form 1065? If you have not received Form 1065, submit your W-2 and Form 1065 in PDF format.

What will my state tax return file look like? Massachusetts Tax Returns For Massachusetts residents: Your new state income tax return will be e-filed for you by your tax preparer. You do not need to use the online software or services.

Your tax return will also be electronically filed for you on a separate sheet for each tax period. To view a sample Massachusetts tax return, click here. Note You must follow the correct filing requirements of each tax period. Check with your tax preparer for additional information.

What happens after my return is filed? Your return will include any balance due with state withholding.

Your new state gross income tax will be due to your local income tax office.

If you are filing a Schedule C, you may receive a check for the balance due. Your state withholding will be shown as amount not received, as shown in the Amount not received column of your 1040A.

What are the different types of IRS W-3 2018 Form?

You can also read: What are the IRS W-3 2018 Forms, and What Are the Different Types for 2018?

What to Do Before You File

1. If you're applying for an extension of time to file your return, get a copy of your 2018 W-3 form, along with your current IRS return (for instance, if you filed Form 1040X this year and your previous tax return is due in April, you will need to get Form 1040X-EZ and then Form 1040X-EI to get an extension). You'll need to review everything in both reports and get all forms, schedules, and instructions and to sign them. See IRS Publication 559, Return of Withholding on Wage and Tax Amounts and IRS publication 559, IRS Wages and Deductions for more information. Note these forms have different formats and are available on the Internet at:. 2. You will need to sign and date all the 2018 Forms you file. You will need to get Form 8916-EZ (with W-3 form) and Form 8916-EI (for extension of time to file the original return) signed by the employee (you, your manager, your employee's spouse or other authorized representative). Do not send these forms by mail. You will need to do this only if your employee fails to sign these forms. 3. Before you file, you should also get Form 8916-GZ (with an IRS W-3 for you), Form 8916-EZ (for the extension), and the W-2 if you paid some of your employee's wages in 2017. You may have to pay the employee income tax under both income tax rules if that is the case. See IRS Publication 549 for more information. Keep a copy of your copies of Form 8916-GZ, Form 8916-EZ, and W-2 for your records in case a Form 8916-GZ or Form 8916-EZ is appealed, or you get a new W-2. 4. You will need to have your new filing year's pay stubs ready before you start to file. If you have to file in three months instead of three weeks, you will need your pay stubs for all three years on or before the first day of that period.

How many people fill out IRS W-3 2018 Form each year?

Tax year 2018 is the earliest, because the last tax return filed is due before tax day on April 18, 2018. Tax year 2017 is the latest, because the last return filed is due after tax day on April 18, 2017. The most recent return filed was for tax year 2016.

How many people fill out IRS W-4 2018 Form each year?

Tax year 2018 is the earliest, because the last tax return filed is due before tax day on April 18, 2018. Tax year 2017 is the latest, because the last return filed is due after tax day on April 18, 2017. The most recent return filed was for tax year 2015.

How many people fill out IRS Form W-5 2018?

Tax year 2018 is the earliest, because the last tax return filed is due before tax day on April 18, 2018. Tax year 2017 is the latest, because the last return filed is due after tax day on April 18, 2017. The most recent return filed was for tax year 2014.

How many people fill out IRS Form W-8 2018?

Tax year 2018 is the earliest, because the last tax return filed is due before tax day on April 18, 2018. Tax year 2017 is the latest, because the last return filed is due after tax day on April 18, 2017. The most recent return filed was for tax year 2013.

How many people fill out IRS W-9 2018?

Tax year 2018 is the earliest, because the last tax return filed is due before tax day on April 18, 2018. Tax year 2017 is The latest, because the last return filed is due after tax day on April 18, 2017. The most recent return filed was for tax year 2012.

How many people fill out IRS Form W-9/10 2018?

Tax year 2018 is the earliest, because the last tax return filed is due before tax day on April 18, 2018. Tax year 2017 is The latest, because the last return filed is due after tax day on April 18, 2017. The most recent return filed was for tax year 2011.

How many people fill out IRS Form W-10 2018?

Tax year 2018 is the earliest, because the last tax return filed is due before tax day on April 18, 2018. Tax year 2017 is The latest, because the last return filed is due after tax day on April 18, 2017. The most recent return filed was for tax year 2010.

Is there a due date for IRS W-3 2018 Form?

What are your tax responsibilities?

What if I miss a payment?

I forgot to file a Social Security tax return by the due date. What should I do?

How do I find information for my child under the age of 16 living at my home?

How long will it take the IRS to process all the tax returns my company has filed for me this year?

I just received a letter from the IRS asking for copies of my personal tax statements.

If you believe that this page should be taken down, please follow our DMCA take down process here